Why Choose ICMS

Built by practitioners for practitioners.

As a team, we have spent decades leading decisioning and data science in financial services, with a strong presence in consumer lending. In previous roles, we have lead transformations from first principles across decisioning, bureau strategies, credit policies, product design, collections, and data infrastructure. That lived experience directly informs how we design and deliver our solutions today.

Deep Domain Expertise

We understand the full lifecycle of decisioning from data and model build to governance, audit, and compliance and know where the real-world risks and friction points lie.

Augmented by Expert Support

Our in-house data science and strategy teams help clients design, build, and deploy models, decision strategies, and controls — accelerating outcomes and reducing risk.

Thoughtful and Collaborative

We invest the time to deeply understand our clients’ processes, objectives, and long-term vision — ensuring the right design from day one and providing continuous support beyond go-live.

Ways of Work

Our engagement approach is structured to ensure clarity, efficiency, and measurable value at every step.

Modular technology stack built for

adaptability & performance

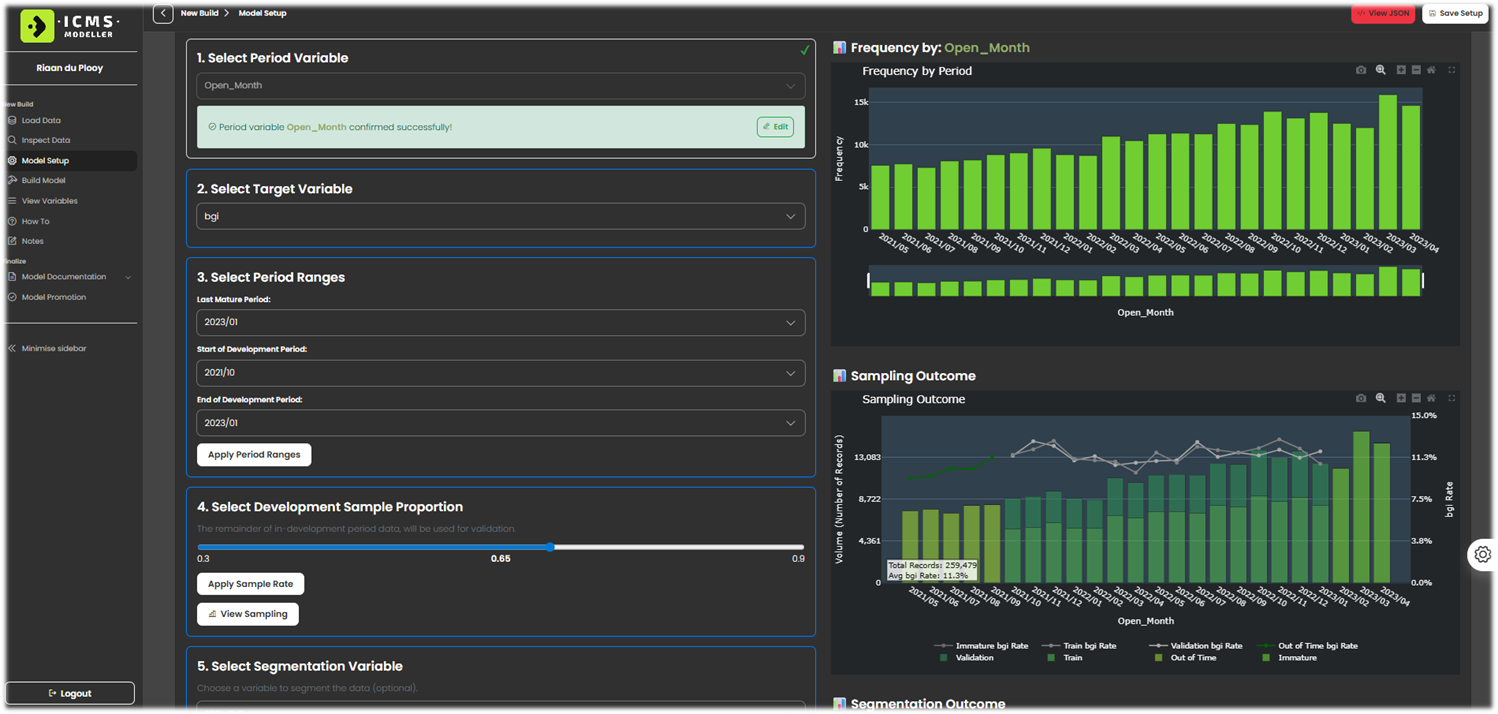

ICMS Modeller

Empowering Users to Build, Evaluate, and Govern Models.

A low/no-code solution for logistic regression modelling (robust binning / WOE based) and lifecycle management.

“From dataset to deployment, our tool gives your team control, visibility, and compliance—all in one role-based platform.”

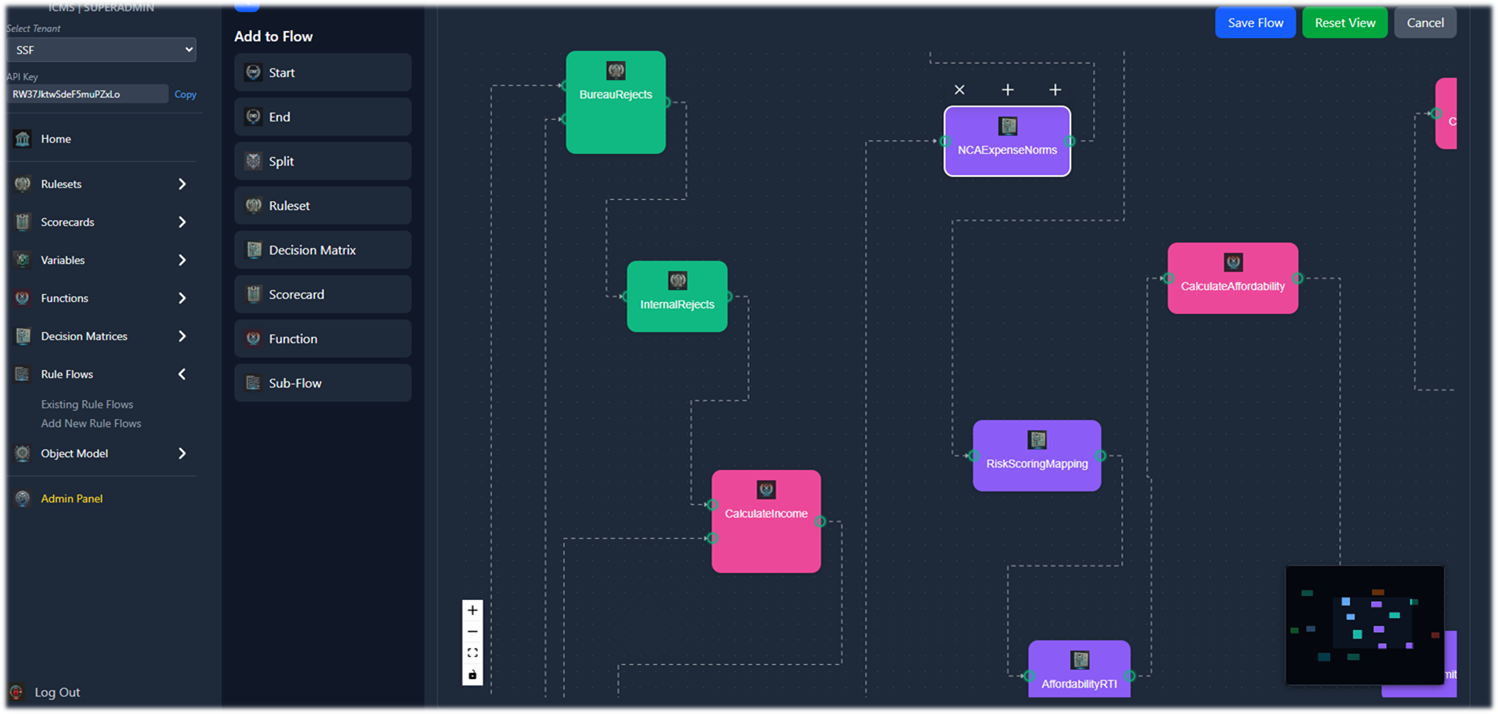

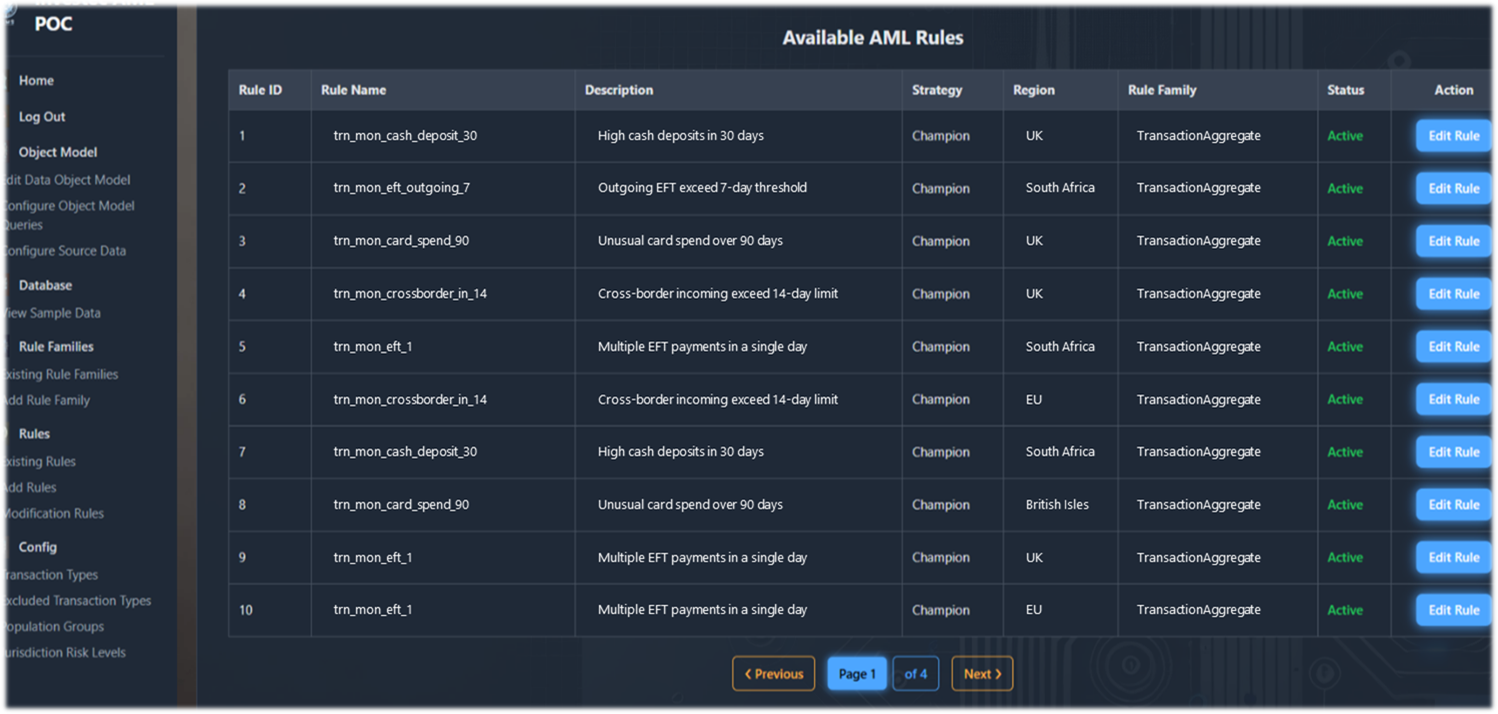

ICMS Decisioner

Smarter decisioning. Faster execution. Stronger governance.

Our decisioning engine empowers organisations to design, deploy, and govern decisions at scale.

“Flexible decisioning in an intuitive low-code interface for business users, whilst enabling advanced coding capabilities for developers—all within a single platform.”

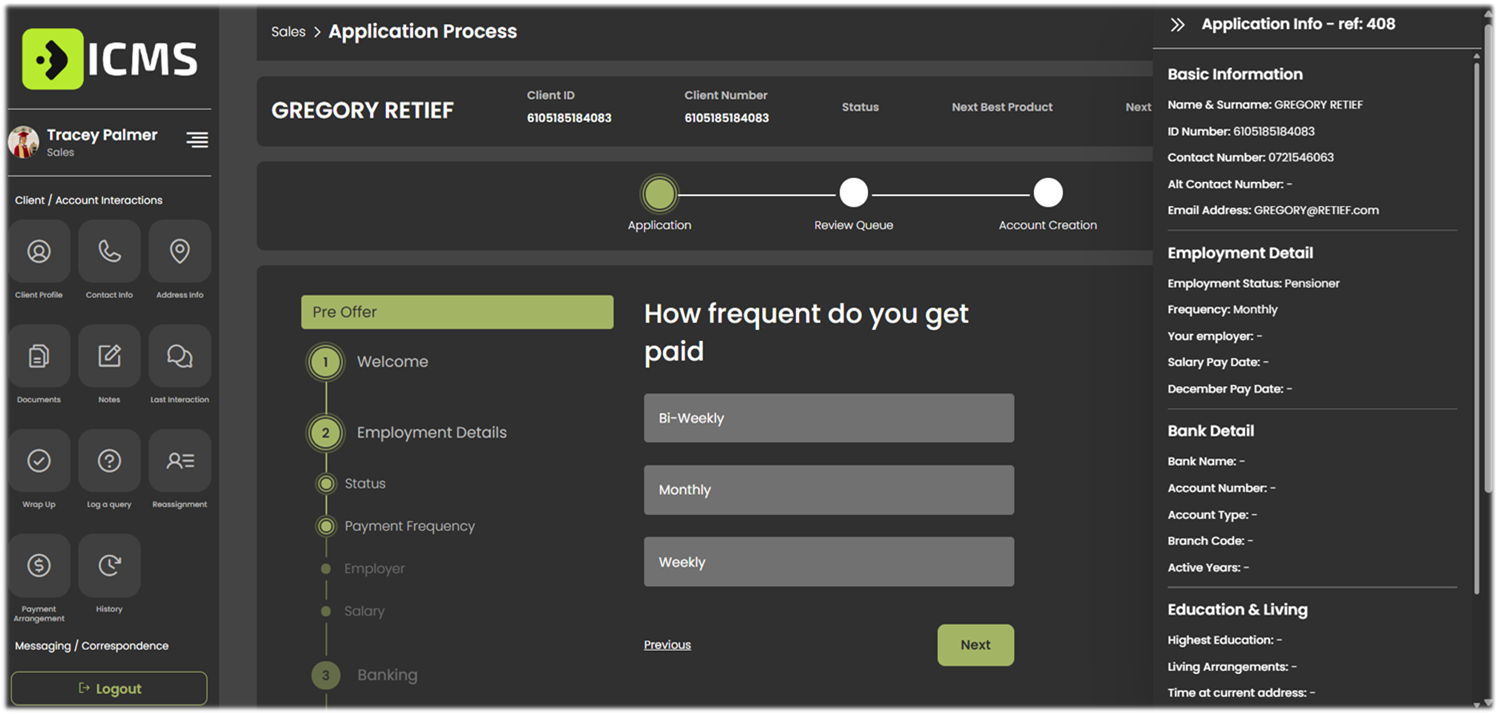

ICMS Workflow

A Configurable Customer and Agent Workflow Platform for Seamless Customer Journeys.

Powered by an intelligent decision engine to ensure fast, personalized, and compliant experiences.

“Allowing Customers to move effortlessly between digital self-service and agent-assisted channels without losing progress.”

Partners Network

Our solutions are strengthened by a select network of partners that complement our decisioning and workflow capabilities: