A Platform Built for Performance

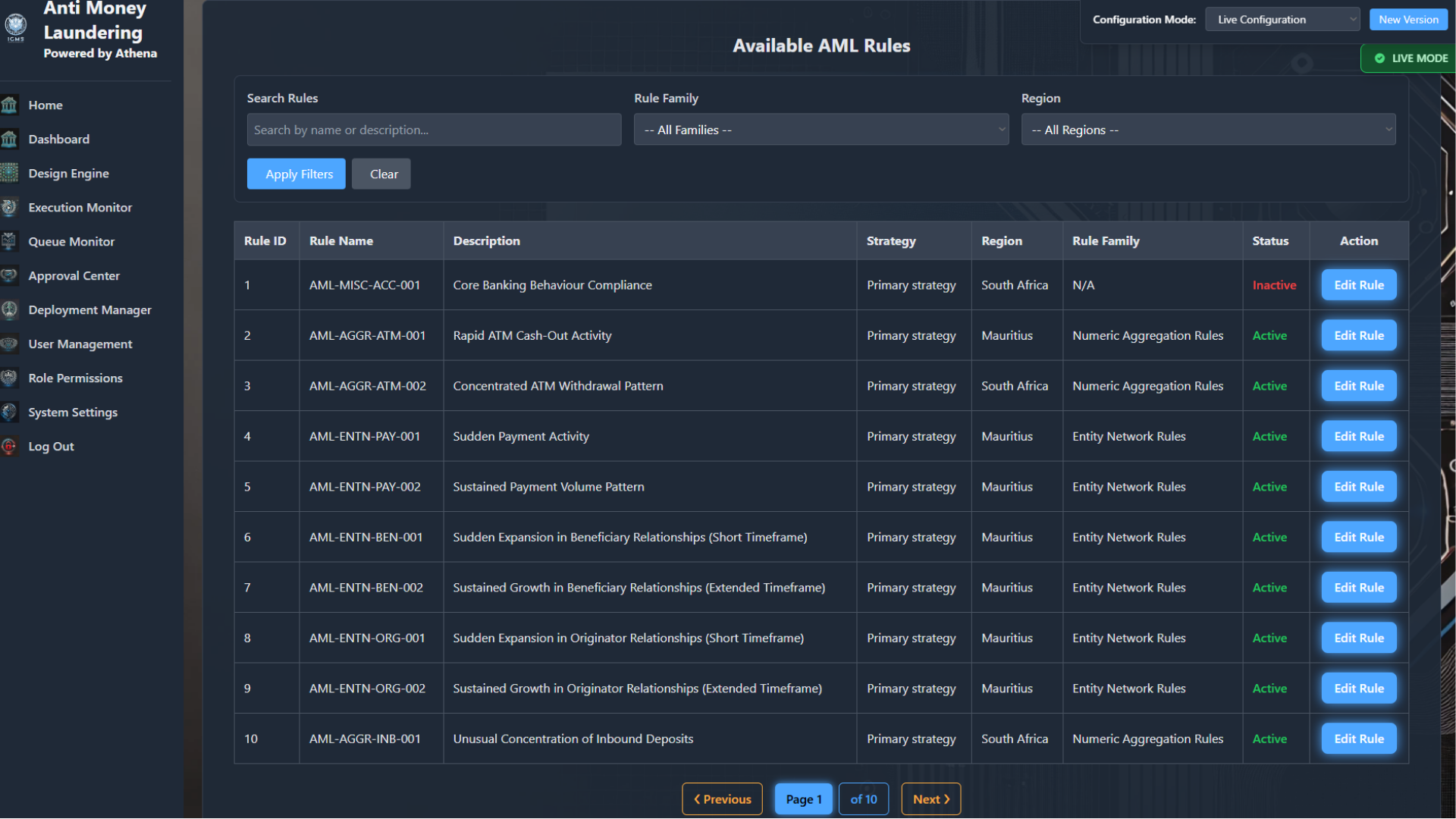

ICMS provides a suite of configurable tools designed to meet the demands of fast-moving enterprises. Whether you’re focused on onboarding, risk, compliance, or optimisation, our solutions are designed to be modular, scalable, and fully integrated.

Our Solutions

ICMS delivers a flexible, intelligent platform to solve critical business challenges through data-driven automation and advanced decisioning. Whether you’re managing onboarding, risk, compliance, or credit, ICMS adapts to your environment fast.

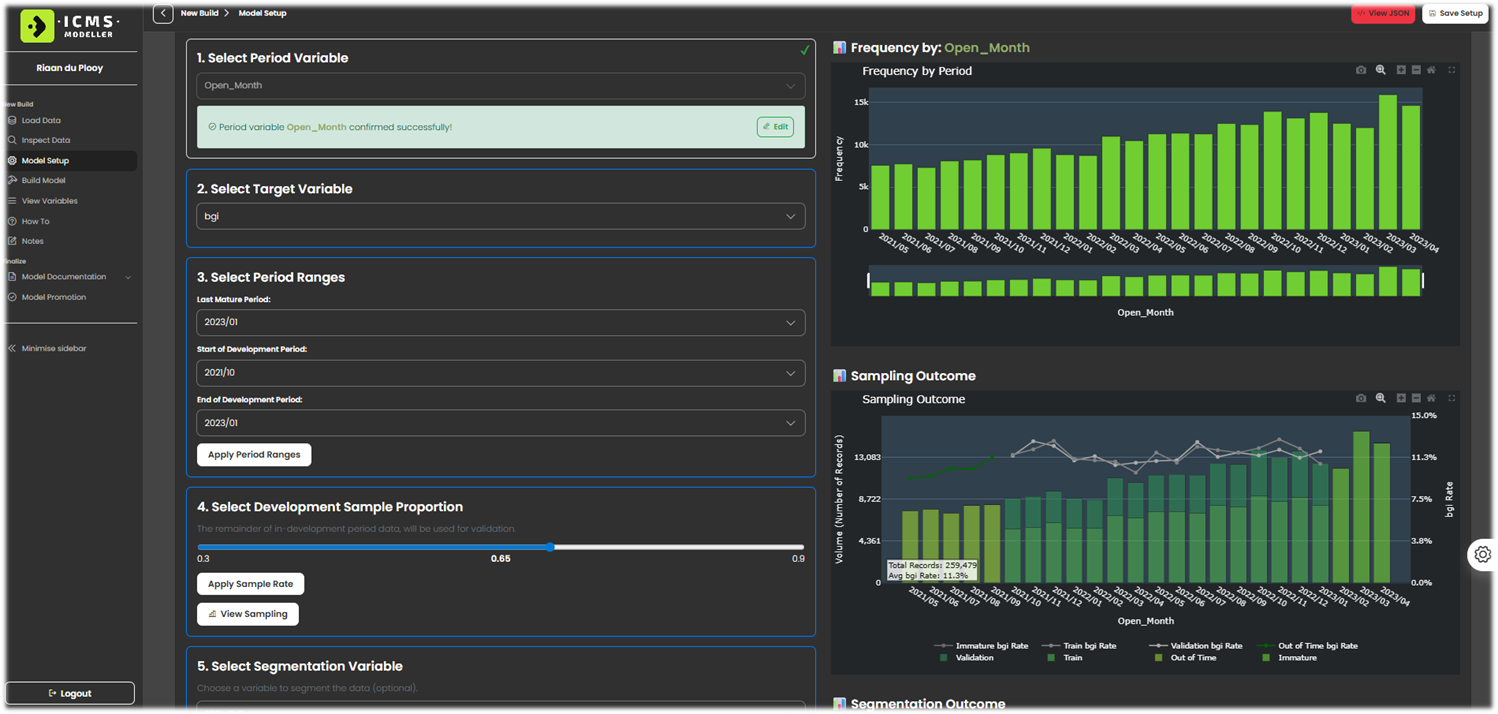

ICMS Modeller

Empowering Users to Build, Evaluate, and Govern Models.

A low/no-code solution for logistic regression modelling (robust binning / WOE based) and lifecycle management.

“From dataset to deployment, our tool gives your team control, visibility, and compliance—all in one role-based platform.”

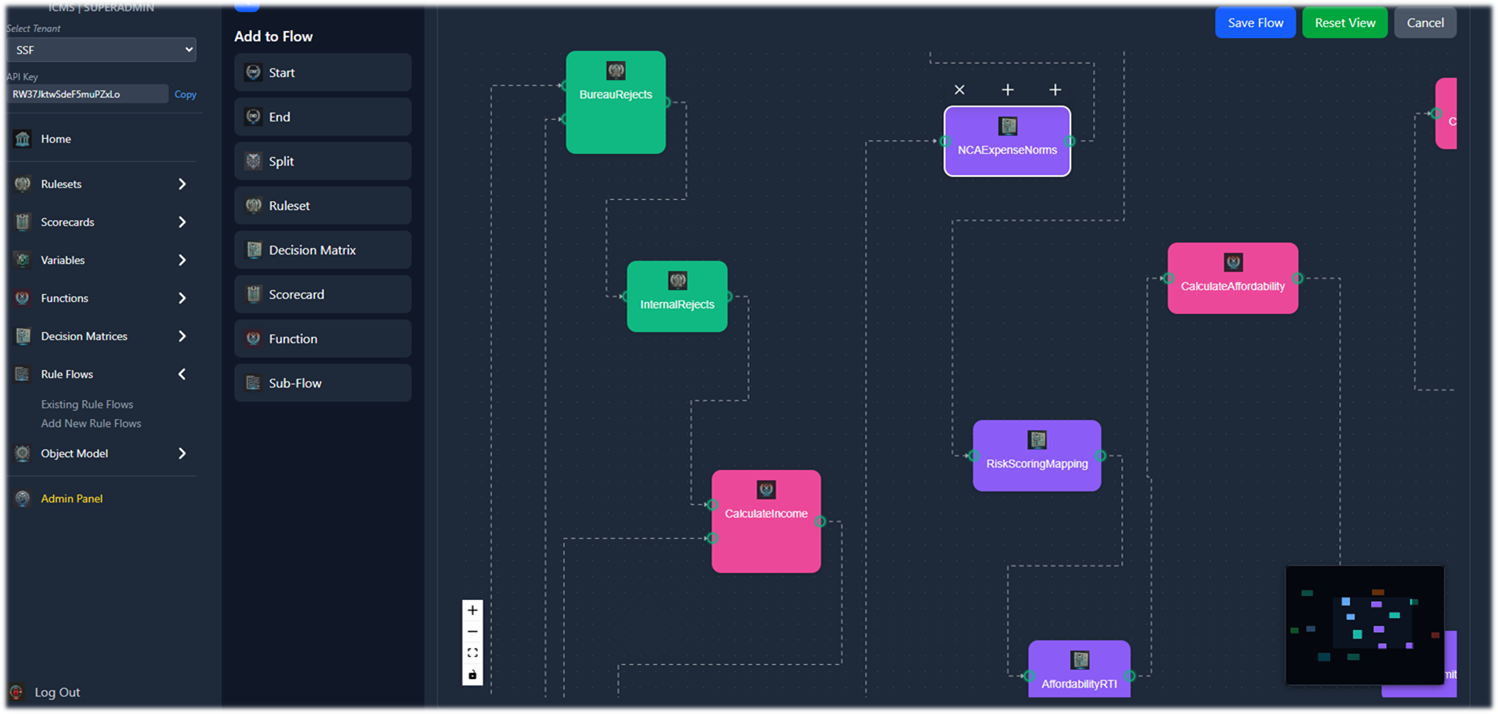

ICMS Decisioner

Smarter decisioning. Faster execution. Stronger governance.

Our decisioning engine empowers organisations to design, deploy, and govern decisions at scale.

“Flexible decisioning in an intuitive low-code interface for business users, whilst enabling advanced coding capabilities for developers—all within a single platform.”

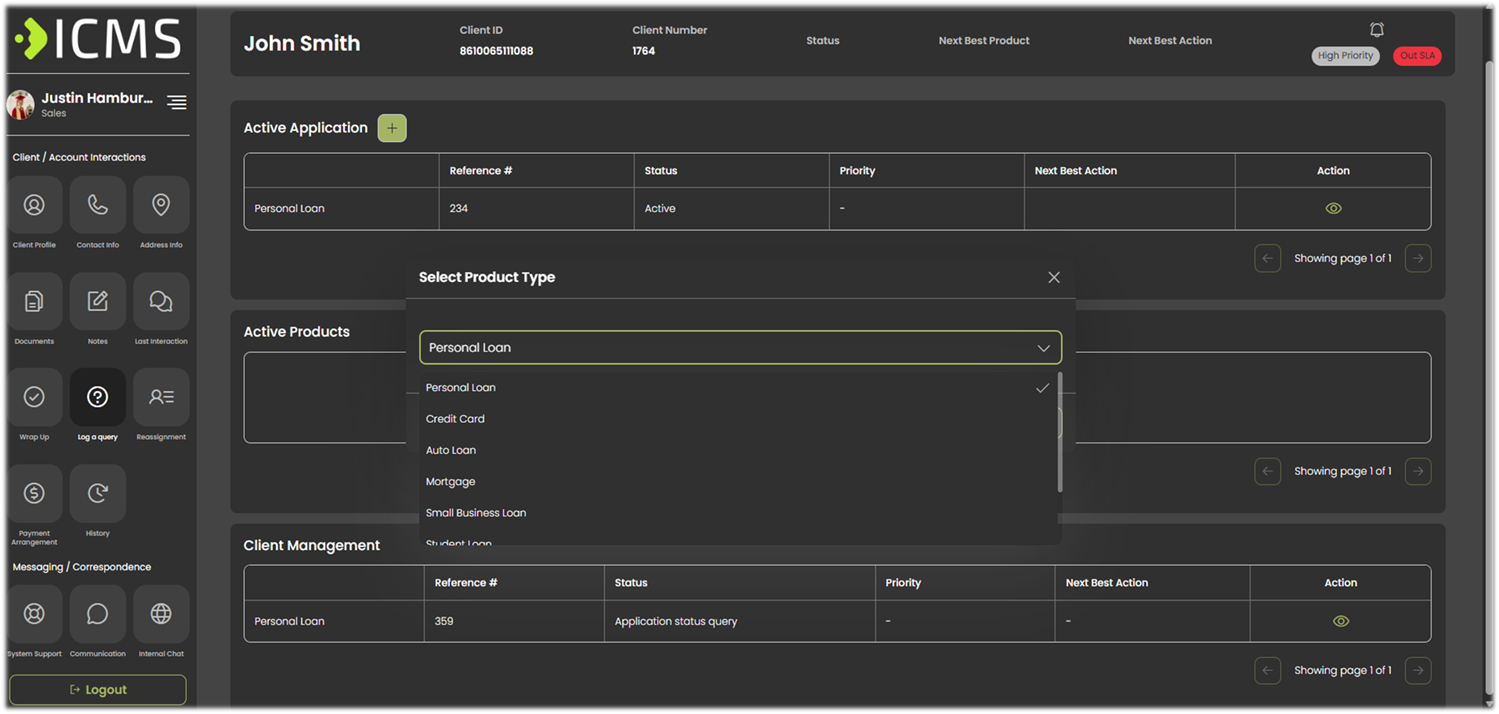

ICMS Workflow

A Configurable Customer and Agent Workflow Platform for Seamless Customer Journeys.

Powered by an intelligent decision engine to ensure fast, personalized, and compliant experiences.

“Allowing Customers to move effortlessly between digital self-service and agent-assisted channels without losing progress.”

Real-World Use Cases

ICMS powers transformation across financial services, lending, and compliance. Here’s how our platform delivers results.

The ICMS Advantage

ICMS delivers agile automation, smart optimization, strong governance, and data-driven intelligence—powering seamless customer journeys and smarter, faster decisions.